Whether your idea of the perfect trip is on the beach with your feet up or hiking up mountains, travelling has a common theme; cost. It is rarely cheap to go on any sort of trip, and if money is tight month to month it can feel like you are never going to be able to save for the next trip. Lots of us see travel as almost essential in this day and age.

With our phones and email being accessible 24/7 we may never really switch off when we’re at home. Travel can be a way to recharge our batteries, and though it feels expensive, there are ways you can save money to ensure the cost is not out of reach.

We’ve collected some of the best money saving apps to get you ready for your next trip.

1. Acorns

Acorns is a clever money saving app concept that mixes saving small amounts with investing. There is capital at risk here, but usually, people end up saving and even growing their money. If you spend $2.70 on a sandwich, Acorn will round the cost up to $3, taking the remaining 30c and investing it.

You can choose to invest more if you want, and you also have options for the type of account your money is in. Some are higher risk, but these can bring higher rewards and increase your savings a lot.

Under 25s and university students can use the app totally free!

What we like about this app as much as anything is the way the savings are made. Because it is simply rounding up purchases, it is unlikely that you will feel the effects of a few cents here and there leaving your account. You may not even notice it day-to-day, but the money is accruing and gaining interest too.

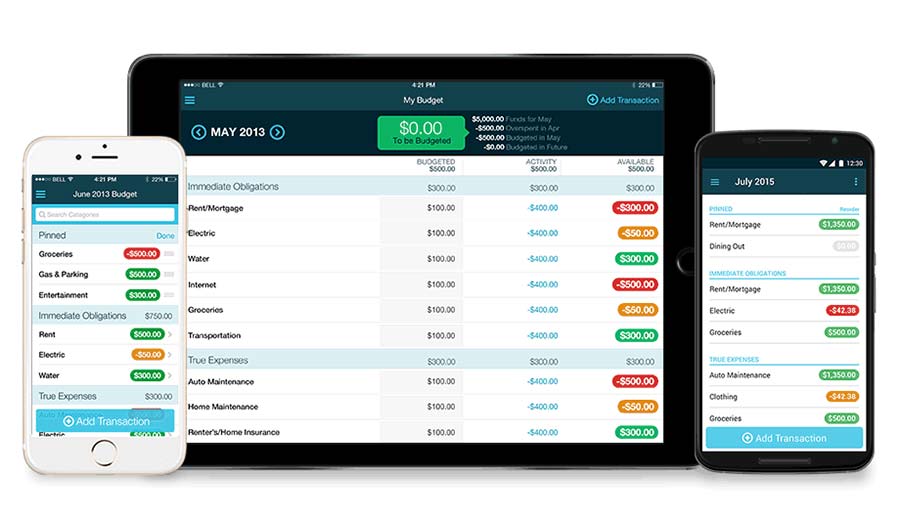

2. YNAB – You Need a Budget

Budgeting apps can be a great way to change your spending habits and make sure no penny is wasted. With YNAB, you can set how much money you need to spend month to month on things like your mortgage, bills and food, knowing that this is all accounted for. On top of that, you can set savings goals, working out how much you can put aside each month and how quickly this will lead you to your goal.

So many of us don’t plan out our money correctly. Of course, there is always the chance of unexpected bills cropping up but normally we have a rough idea of what we can afford and how much of our money is accounted for month to month. Using a budgeting app such as You Need a Budget can ensure money doesn’t get frittered away and that your next trip becomes a priority. This app isn’t free but does have a free trial, and the monthly cost is usually justified by the savings you can make.

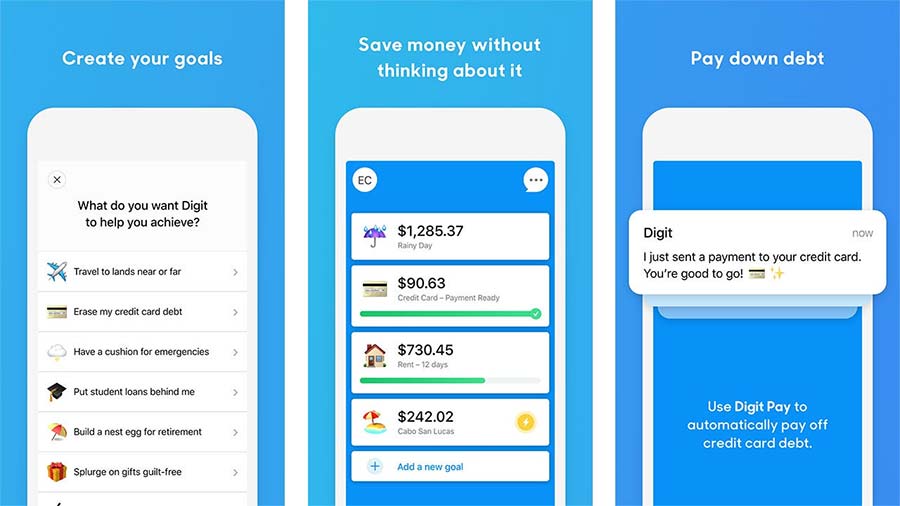

3. Digit

Digit takes a slightly different approach. It is still technically a budgeting app, but automated. The app cleverly monitors your spending and how much you are spending each day as well as your monthly commitments. With this in mind, it then takes what it can safely take from your account and stash away for the big trip you’re dreaming of.

This is appealing for people who don’t have a lot of time on their hands. Because it is automated, you don’t have to constantly be feeding it information or making changes yourself. Set your target and let Digit do the hard work.

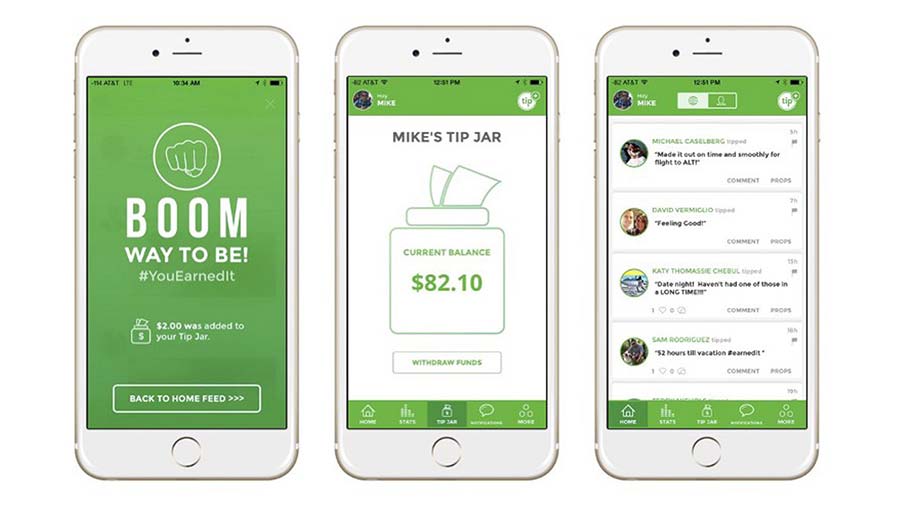

4. Tip Yourself

This app appeals more to the psychological side of saving! Tip Yourself allows you to put small amounts of money into your ‘tip jar’ when you see fit. The idea behind it is that you tip yourself based on achievements and getting things done. Maybe you decide you’re going to tip yourself every time you go to the gym or even a couple of dollars every day you complete at work, it can be a good way to boost your own morale and incentivize your saving efforts.

5. Grocery Smarts

Saving money is not just about putting it in a savings account or cutting back, it can be about spending habits too. One of the most effective ways to save without making any real sacrifices is to simply look for the best prices for things and make sure you don’t spend more than you need to on everyday items.

Grocery Smarts combines the concept of ‘circulars’ or visiting multiple stores to pick up the best deals, with the best coupons out there. If you are close to the biggest chain stores out there and are able to go to more than one to pick up the best deals, Grocery Smarts will do all of the legwork to ensure you are always finding the best prices on your weekly shopping.

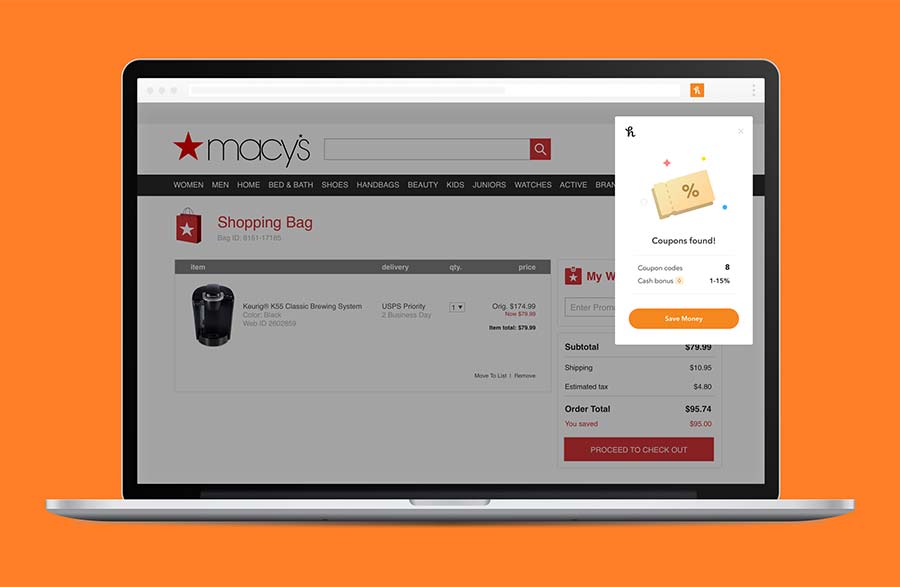

6. Honey

Honey is a very intelligent app that serves as an extension to your browser. Honey will automatically find deals on pretty much anything you are shopping for and can even be set to automatically apply codes to ensure savings. This isn’t just an app that will occasionally save you a bit of cash, some of the sites they are partnered with are big, impressive brands and the offers you wouldn’t have otherwise known about can make a huge difference.

7. Walla.by

Most of us use credit cards at some point in our lives, even if just to build a credit score for future lending. We aren’t all doing it efficiently though. Walla.by is an app designed to manage your credit card spending but also give you tips on retailer rewards, credit card offers and even track how close you are to your spending limit. The app is even available as a wearable device application so you can always have it on you! Credit cards can easily wind up costing a fortune, and you may well have been tempted in with a good early offer only to find yourself having to pay loads of interest in the long run.

Conclusion

You will probably have a good idea just from reading through these apps which ones will be most helpful for you. There are different types of savers. Some struggle with the psychology of saving, some struggle with the motivation to save, some struggle with the maths of working out how to pay bills and commitments and still end up with money left to save.

Certain apps will help universally, being able to apply coupon codes or find more affordable ways to borrow money and increase credit scores are always handy, whether you’re on minimum wage or are earning more than you need.

Vacations and trips shouldn’t necessarily be sacrificed if things get tight, and using the budgeting tips here is a great way to do your best to put money to one side. There are also things you can do to earn a little extra cash for your next trip. Combining the two gives you the best chance for the vacation of a lifetime. No let’s get some inspiration for your net destination.