This article is specifically for non-EU spouses who are married to an EU citizen and want to understand their residency options without triggering tax residency obligations. The focus in this article is on using the 5-year EU family residence card as a travel tool, not as a path to permanent settlement. Before we go into details of each country there are some common terms to get though first.

The 183-Day Tax Residency Rule

The European Union applies the 183-day test to determine if you become a tax resident in a country. Spend more than 183 days, or move your financial and family life there, and you risk being taxed on worldwide income.

EU Registration Requirement

If you plan to stay more than 3 months in one EU country, you are legally required to register your residence and will be issued a residence card. If you spend shorter stays, you don’t need to register. There is a difference between countries though: in some (Italy, France and Belgium, for example) just registering triggers tax residency, even if you stay less than 183 days.

Schengen Spouse Rights

As the non-EU spouse of an EU citizen, you have the right to live and travel anywhere in the EU where your partner exercises free movement, under Directive 2004/38/EC, Articles 6–7. This right lets you stay longer than the 90/180 Schengen tourist limit, but only if you are entering and leaving Schengen together with your EU spouse. So yes you can do a 5 to 7 month trip around Europe, but make sure to enter and exit with your EU spouse.

EU Residence Card Benefits and Limits

Once you obtain an EU residence card, by staying and registering in the country where you intend to stay for more than 3 months, you can apply for a 5-year EU residency card, you no longer need to worry about the 90-day tourist restriction. The card also lets you travel alone within Schengen for longer than 90 days and to enter and exit the Schengen zone without being accompanied by your EU spouse.

However, there’s an important distinction: if you want to convert a 5-year residence card into a 10-year permanent residence card, you must show proof of at least 6 months of actual residence each year in that country. This requirement will normally trigger tax residency. If your goal is only to use the 5-year card for Schengen flexibility, you can reapply in the same or another EU country once it expires — but the 5 years will not count toward permanent status.

The New Entry/Exit System (EES)

From 2025/2026, the EU will implement the Entry/Exit System (EES), which electronically records the entry and exit of all non-EU nationals, including residence card holders.

- With a residence card, EES exempts you from the 90/180 tourist rule, but it will log every absence and entry.

- If you are absent for more than 6 months per year, immigration authorities can use this record to deny renewal or permanent residence.

- Your card will still work at the border until it expires, but your absences will be visible.

- An absence of 2 years or more of the Schengen zone normally results in the loss of your residence card. (no hard limit and the residency card needs to be revoked by the country itself)

Overall theme: The 5-year residence card can be used as a flexible travel tool for non-EU spouses of EU citizens, allowing stays beyond 90 days and independent Schengen travel, but EES will make long absences traceable. This means you can enjoy the benefits short-term, but you should not expect to qualify for permanent residence unless you truly reside 6+ months each year in one country and thereby triggering tax residency.

General Requirements to Get a Residence Card

While exact rules vary slightly between EU countries, most require the following documents for a non-EU spouse residence card application:

- Valid passports of both the EU citizen and non-EU spouse.

- Marriage certificate (apostilled and, if needed, officially translated). unless an EU marriage certificate.

- Proof of residence address in the host country (rental contract, property deed, or host declaration).

- Proof of sufficient financial means (bank statements, pension income, or EU spouse’s support declaration).

- Health insurance covering the host country.

- Completed application form at the local immigration office or municipal authority.

1. Portugal – The Golden Choice

- Residence card: 5 years → 10-year permanent card.

- Tax residency: Only >183 days or habitual residence.

- Why it works short-term: Hold a card without taxation if you stay less than half the year.

- Lifestyle perks: Coastal living, strong expat hubs, English-friendly.

2. Spain – Bureaucratic but Predictable

- Residence card: Tarjeta de Residencia de Familiar de Comunitario (5 years → permanent).

- Tax residency: 183+ days or centre of vital interests.

- Why it works short-term: Card allows freedom to travel beyond 90/180 without taxes if <183 days.

- Lifestyle perks: Rich expat life in Barcelona, Valencia, and the islands.

3. Greece – Simple and Straightforward

- Residence card: 5 years → permanent.

- Tax residency: Only >183 days.

- Why it works short-term: Like Romania, you can hold the card lightly without taxation.

- Lifestyle perks: Island life, beaches, food & affordable living.

4. Slovenia – Schengen Access Without Italy’s Tax Trap

- Residence card: 5 years → 10-year permanent.

- Tax residency: 183+ days or centre of life.

- Why it works short-term: Safer than Italy, no automatic tax trigger.

- Lifestyle perks: Close to Northern Italy; mountains, lakes, Adriatic coast.

5. Czech Republic – Central European Stability

- Residence card: 5 years → permanent.

- Tax residency: 183+ days or centre of interests.

- Why it works short-term: Hold the card without triggering tax if under 183 days.

- Lifestyle perks: Prague expat hub, affordable cost of living.

6. Hungary – Low-Bureaucracy Advantage

- Residence card: 5 years → permanent.

- Tax residency: 183+ days or centre of life.

- Why it works short-term: Simple application; hold residence without full taxation.

- Lifestyle perks: Budapest’s culture, spas, and affordability.

7. Poland – Big-City Practicality

- Residence card: 5 years → permanent.

- Tax residency: Only if >183 days.

- Why it works short-term: Residence card without automatic taxation.

- Lifestyle perks: Warsaw, Kraków, Gdańsk with growing expat scenes.

8. Croatia – Newest Schengen Entrant

- Residence card: 5 years → permanent.

- Tax residency: 183+ days or centre of life.

- Why it works short-term: Flexible like Greece; hold the card lightly.

- Lifestyle perks: Adriatic coast, Mediterranean lifestyle.

9. Slovakia – Quiet and Predictable

- Residence card: 5 years → permanent.

- Tax residency: 183+ days or centre of life.

- Why it works short-term: Legal card without automatic taxation.

- Lifestyle perks: Bratislava close to Vienna; peaceful and affordable.

10. Romania – A Proven Model

- Residence card: 5 years → 10-year permanent.

- Tax residency: Only >183 days.

- Why it works short-term: Possible to hold a card without triggering taxation, though permanent residence requires actual living.

- Lifestyle perks: Bucharest, Transylvania, growing tech scene.

Other Countries in Summary

The 10 countries above are among the most practical, but the EU free movement directive applies everywhere. Here is a quick overview:

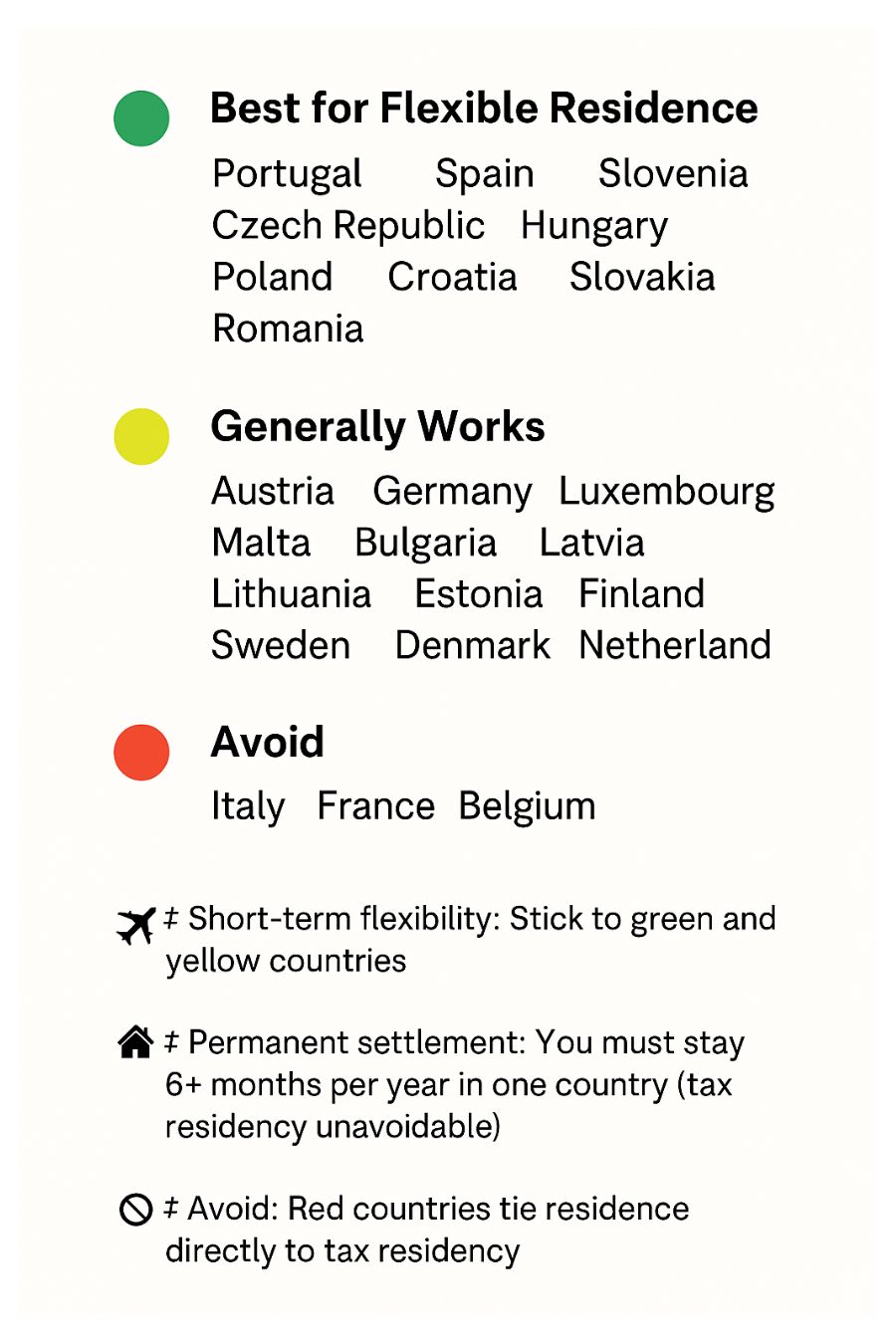

Where it Generally Works (Summary)

- Austria – Card available, but bureaucracy heavier; safe if under 183 days.

- Germany – Works, though local offices vary in strictness; avoid triggering tax residency by keeping stays short.

- Luxembourg – Possible, but small and stricter on documentation.

- Malta – Applies, though more costly and small scale.

- Latvia, Lithuania, Estonia – All follow the same directive; smaller expat networks, but system works.

- Finland, Sweden, Denmark – Works legally, though Nordic countries have tighter administrative checks.

- Netherlands – Works under the EU free movement directive when applied as host country.

In all of these countries, the short‑term strategy is the same: you can obtain a 5‑year card as a spouse, but long absences visible in EES mean no path to permanent residence without 6+ months/year presence.

Important Note on Passport Country

If you are the EU citizen, you should avoid registering residence in your own passport country. In that case, EU free movement rules do not apply, and instead the stricter national immigration laws of that country govern your spouse’s application (for example in the Netherlands with the IND requirements).

Countries to Avoid

- Italy – Commune registration = automatic tax residency.

- France & Belgium – Residence registration closely tied to taxation.

Practical Tips for Non-EU Spouses

- Documents: passports, marriage certificate (apostilled/translated), proof of residence address, health insurance, proof of sufficient means.

- Absence rules: Don’t be absent >6 months/year; one 12-month justified absence allowed. If you are absent slightly longer than 6 months (for example, 6.5 months away to maintain tax residence in Thailand), the 5-year residence card is generally not revoked immediately, but this absence will break the continuity needed for permanent residence. Immigration may also question your ties to the host country at renewal if you cannot show a maintained address. An absence of 2 years or more normally results in the loss of your residence card and resets the clock if you want to apply again.

- Tax rules: Immigration residence ≠ taxation. In most EU countries, tax residency only begins at 183+ days or if your centre of life shifts there.

- Short-term strategy: Use the 5-year residence card for extended stays and Schengen flexibility without taxation.

- Long-term strategy: To get permanent residence (10 years), you must show 6 months/year stay → this usually means triggering tax residency.

Conclusion

For non-EU spouses of EU citizens, the EU offers strong rights to secure residence — but your approach matters. With the new EES system, absences longer than 6 months will be logged and visible, meaning permanent residence is off the table unless you truly live in one country.

If your goal is flexibility and the ability to travel in and out of Schengen freely without being tied to the 90-day rule, a 5-year residence card is ideal. If your goal is permanence, you must commit to living at least 6 months per year in one country — which will almost certainly make you a tax resident.

Portugal, Spain, and Greece are the most popular flexible choices; Slovenia and Romania are hidden gems. The right balance depends on whether you value tax freedom or permanent settlement.