In an increasingly globalized world, sending money abroad has become a common necessity for individuals and businesses alike. Whether you’re supporting family members overseas, paying for services, or conducting international business transactions, finding the most efficient and cost-effective way to send money across borders is crucial. This comprehensive guide will help you navigate the complexities of international money transfers and explore the best options available to suit your needs.

Factors to Consider When Sending Money Abroad

When evaluating the various methods of sending money abroad, it’s essential to consider several factors that can significantly impact the overall cost and effectiveness of the transfer. The following are some key aspects to take into account:

Exchange rates

The exchange rate is the value at which one currency is converted into another. It is a critical factor when sending money abroad, as it can significantly affect the amount received by the recipient. Be aware that exchange rates fluctuate throughout the day, and not all providers offer the same rates. Some money transfer services may advertise “zero fees” or “low fees,” but they may compensate for this by offering less favorable exchange rates. To ensure you’re getting the best deal, compare the total cost of the transfer, including both fees and the exchange rate.

Transfer fees

Fees associated with international money transfers can vary widely depending on the service provider and the method of transfer. These fees can be charged as a flat rate or a percentage of the transfer amount. Some providers may also charge additional fees for specific services, such as expediting the transfer or receiving funds in a different currency. Be sure to compare the total cost of the transfer, including fees and exchange rates, to find the most cost-effective option.

Speed of the transfer

The time it takes for the recipient to receive the funds can be an essential factor, particularly in urgent situations. Traditional bank transfers can take several days or even weeks, whereas some online money transfer services can complete the transaction within minutes. However, faster transfers may come with higher fees, so it’s important to weigh the need for speed against the cost.

Reliability and security

Ensuring that your money reaches its destination securely and without any issues is paramount. Research the reputation of the money transfer service or bank you plan to use and check for any history of security breaches or customer complaints. Look for services that utilize encryption and other security measures to protect your financial information.

Ease of use and customer service

The user experience and customer support provided by a money transfer service can make a significant difference in the overall satisfaction with the process. Opt for services with user-friendly platforms, clear instructions, and responsive customer service teams to help you navigate any issues that may arise during the transfer.

In the next section, we will explore some popular money transfer services and compare their pros and cons to help you determine the best option for your needs.

Popular Money Transfer Services

There are numerous money transfer services available, each with its own set of features, fees, and exchange rates. MoverFocus is an excellent resource to compare the different money transfer companies available. The following is a comparison of some popular options to help you make an informed decision:

Wise (formerly TransferWise)

Wise is an online money transfer service known for its competitive exchange rates, which are generally close to the mid-market rate. They charge a low, transparent fee based on the transfer amount and destination.

Pros:

- Competitive exchange rates

- Transparent fee structure

- User-friendly platform

- Supports over 50 currencies

Cons:

- Not ideal for urgent transfers, as it may take 1-3 business days to complete

- Not all countries are supported

Western Union

Western Union is a well-established money transfer service with an extensive global network of agent locations. They offer both online and in-person transfers, with the option to send money directly to a bank account or for cash pickup.

Pros:

- Wide global reach with over 200 countries and territories supported

- Multiple transfer options, including cash pickup and bank transfers

- Faster transfers available, with some transfers completed within minutes

Cons:

- Fees and exchange rates can vary significantly depending on the destination and transfer method

- Online transfers may have lower limits than in-person transfers

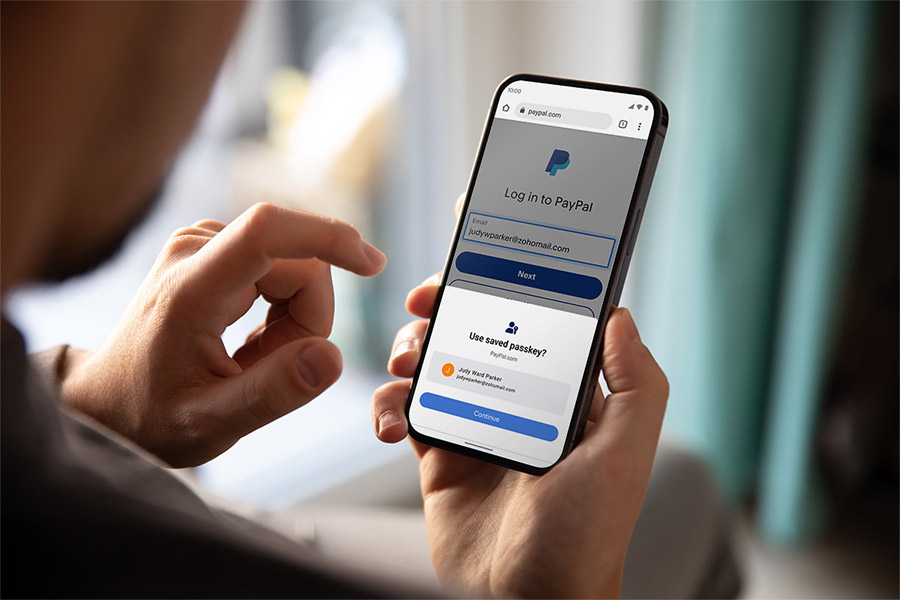

PayPal

PayPal is a popular online payment platform that also offers international money transfers. To send money abroad, both the sender and recipient must have a PayPal account.

Pros:

- Easy to use, especially for those already familiar with the platform

- Instant transfers between PayPal accounts

- Ability to send money to an email address or mobile number

Cons:

- Both sender and recipient must have a PayPal account

- Fees can be high, particularly when sending money in a different currency

- Exchange rates may be less competitive than other services

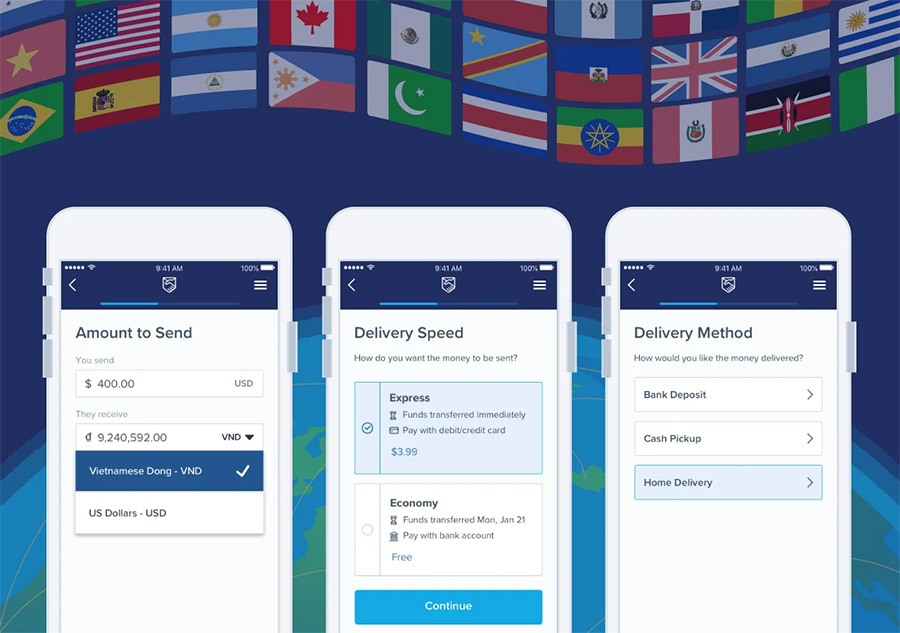

Remitly

Remitly is an online money transfer service focused on making remittances to family and friends abroad. They offer both express and economy transfer options, with varying fees and speeds.

Pros:

- Supports transfers to over 100 countries

- Offers both fast (express) and affordable (economy) transfer options

- User-friendly platform with a dedicated mobile app

Cons:

- Transfer limits may apply, depending on the destination and user verification level

- Exchange rates and fees may be less competitive for non-remittance transfers

Traditional Banking Transfers vs. Online Money Transfer Services

When sending money abroad, you can choose between traditional banking methods, such as wire transfers, and online money transfer services like those mentioned above. Each option has its advantages and disadvantages:

Traditional Banking Transfers:

Pros:

- Generally perceived as more secure due to established banking relationships

- Ability to transfer larger amounts

Cons:

- Slower processing times, often taking several days to complete

- Higher fees and less competitive exchange rates

- Limited customer support outside of banking hours

Online Money Transfer Services:

Pros:

- Faster transfer times, with some services offering instant or same-day transfers

- More competitive fees and exchange rates

- User-friendly platforms with 24/7 customer support

Cons:

- Some services may have lower transfer limits

- The need for additional research to ensure the provider’s reliability and security

In the next section, we will provide tips on how to get the best exchange rates and minimize fees when sending money abroad.

Tips for Getting the Best Exchange Rates and Minimizing Fees

To maximize the value of your international money transfers, consider the following tips to help you get the best exchange rates and minimize fees:

To maximize the value of your international money transfers, consider the following tips to help you get the best exchange rates and minimize fees:

- Compare multiple providers: Before committing to a money transfer service, take the time to compare the total cost of the transfer, including fees and exchange rates, across multiple providers. This will help you identify the most cost-effective option for your specific needs.

- Monitor exchange rate fluctuations: Exchange rates can fluctuate throughout the day, so keeping an eye on these changes can help you time your transfer to get the best possible rate. There are numerous websites and mobile apps that provide real-time exchange rate data and even allow you to set up alerts when your desired rate is reached.

- Choose the right transfer method: The cost of sending money abroad can vary depending on the method you choose. For example, cash pickups or instant transfers may come with higher fees than sending money to a bank account. Evaluate the urgency of the transfer and consider using a more affordable method if time allows.

- Look for promotional offers or fee discounts: Some money transfer providers offer promotional deals or discounts on transfer fees for first-time users or during specific time periods. Keep an eye out for these promotions to potentially save on your transfer.

- Consider using a no-fee or low-fee service: There are some money transfer services, such as Wise, that offer low fees or no fees at all. Although they may compensate for this by offering slightly less favorable exchange rates, the overall cost of the transfer may still be lower compared to providers with higher fees.

Safety Tips for Sending Money Abroad

To ensure the security of your international money transfers, follow these safety tips:

- Verify the recipient’s information: Double-check the recipient’s name, bank account number, and any other required information before initiating the transfer. Mistakes in this information can lead to delays, additional fees, or even the funds being sent to the wrong person.

- Use reputable providers: Stick to well-known, reputable money transfer services or banks to ensure the security of your transaction. Do your research and read customer reviews to gauge the reliability of the provider.

- Protect your financial information: Be cautious about sharing your financial information with anyone, and never disclose your bank account or card details to strangers. When using online money transfer services, ensure the website is secure and uses encryption to protect your data.

- Beware of scams: Scammers may pose as money transfer services or use phishing techniques to trick you into revealing your financial information. Be cautious of unsolicited emails or calls claiming to be from a money transfer service and always verify the authenticity of the communication before proceeding.

When evaluating a money transfer service, it’s essential to ensure they have the necessary accreditations and regulatory compliance in place. The following table outlines some of the key accreditations and licenses to look for in a money transfer service:

| Accreditation / License | Description | Regulatory Authority |

| FCA Authorization | Financial Conduct Authority (FCA) authorization ensures the provider follows the UK’s financial regulations. | Financial Conduct Authority (UK) |

| FinCEN Registration | The Financial Crimes Enforcement Network (FinCEN) registration indicates compliance with U.S. regulations. | FinCEN (U.S.) |

| ASIC License | An Australian Securities and Investments Commission (ASIC) license ensures compliance with Australian rules. | ASIC (Australia) |

| FINTRAC License | A Financial Transactions and Reports Analysis Centre (FINTRAC) license shows adherence to Canadian laws. | FINTRAC (Canada) |

| MAS License | Monetary Authority of Singapore (MAS) license indicates compliance with Singapore’s financial regulations. | MAS (Singapore) |

| EU Passporting | EU Passporting allows a financial institution authorized in one EU country to offer services in other EU countries without additional authorization. | European Union |

Conclusion

Finding the best way to send money abroad requires considering various factors, such as exchange rates, fees, speed, reliability, and ease of use. By comparing different money transfer services, monitoring exchange rates, and following safety tips, you can ensure a secure and cost-effective transfer experience.

While there is no one-size-fits-all solution, online money transfer services like Wise, Western Union, PayPal, and Remitly offer a range of options to suit different needs. Evaluate your specific requirements and prioritize the factors most important to you to find the best way to send money abroad for your unique situation.